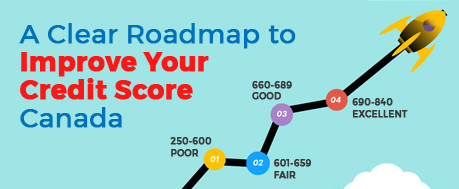

A Clear Roadmap to Improve Your Credit Score Canada

Nothing influences your credit score more than your payment history. So, you should enhance your payment history to boost your score. Monitor the payment history and make a systematic plan to keep your credit score moving. Let us discuss a clear roadmap to improve your credit score Canada for better loan terms.

Study Your Existing Situation

Do you want to make a plan to enhance your credit history? Then, understand where you stand now. Access a copy of your credit report from major credit bureaus. TransUnion and Equifax are the most prominent bureaus in Canada. Study the report carefully. Look for errors or inconsistencies. Ensure that the report precisely represents your current financial situation.

Don’t Delay Payments

Manage Your Credit Card Balances Wisely

You must do credit utilization wisely. Don’t go beyond 30% of your available credit. When it comes to making repayments, prioritize debts with high interest rates. Make payments consistently to reduce the outstanding balances.

Don’t Close Old or Unused Accounts

Many people close accounts that they don’t use anymore. If you have an old account with a good payment history, you don’t need to close it. A temporary dip will occur when you close an existing account. Keep it active even if you don’t use it anymore.

Maintain a Varied Credit Portfolio

Diversification of your credit mix will improve your credit score Canada. Focus on blending various types of credit, including mortgages, installment loans, credit cards, and more. At the same time, don’t handle them irresponsibly. Manage all these accounts carefully to make a difference.

Don’t Apply for New Credits Frequently

Each time you apply for a new credit, a hard inquiry hits your credit report to reduce your score. So, don’t apply for loans frequently. In addition, seek help from credit counselling agencies if you cannot find a way out.

Follow this roadmap to improve your credit score for better loan terms. Never miss payments and maintain a diversified credit portfolio. Keep your credit card limit to 30%. Further, don’t show an urgency to close older accounts. Also, you must be very alert when it comes to applying for new credit. Responsible credit utilization is the fundamental aspect you should focus on to improve your credit score.